Synopsis

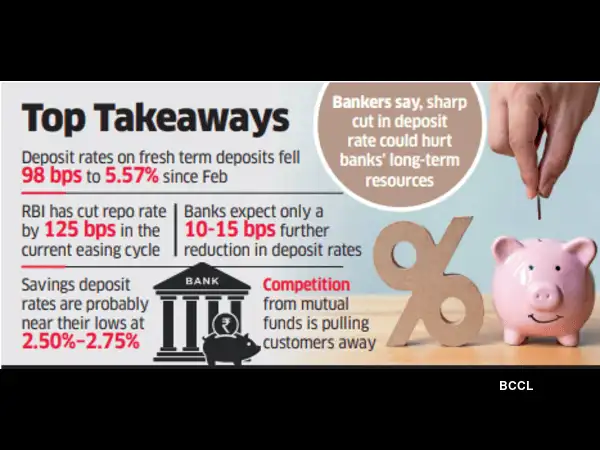

Following the latest repo rate decrease, bankers foresee only slight adjustments to deposit rates. The landscape, characterized by sluggish savings yields and elevated credit-deposit ratios, restricts deeper cuts. Consequently, banks will experience continued margin pressure in the near term. However, a turnaround in profitability is anticipated later this fiscal year.

![]()

Listen to this article in summarized format

Agencies

AgenciesMumbai: A sharp drop in deposit rates, competition from other investment avenues, and a high credit-deposit (CD) ratio is likely to limit scope for further reduction in deposit rates, said bank executives.

Bankers expect only a 10-to-15 basis points reduction in deposit rates following the 25 basis points reduction in the repo rate by the central bank last week.

Inability to pass on rate cuts fully will delay improvement in bank margins, according to bankers. One basis point is 0.01 percentage point.

The weighted average deposit rate on fresh term deposits has fallen 98 basis points to 5.57% since the current rate-cutting cycle began in February. With the latest 25 basis-point cut by the Reserve Bank of India (RBI), the benchmark repo rate is now down by 125 basis points.

However, bankers say further deposit rate cuts will be limited.

"Banks will not be able to pass on the full extent of this cut because we are probably at near lows with savings bank rate at 2.50% to 2.75%," said Binod Kumar, chief executive officer at Indian Bank. "Credit deposit ratio is also high at around 80%, and with intense competition for savers funds from other avenues like mutual funds, deposit rates especially in the flagship one-to-two-year bucket should not come down by more than 10 basis points."

Banks' CD ratio crossed the 80% mark in October, RBI data showed, underscoring challenges for banks to tap fresh deposits even as credit growth picked up in the second half of the year.

Bankers acknowledged that customer behaviour has changed and any sharp cut in deposit rates could have long-term implications for bank resources as customers will consider other higher yielding investments.

"Banks are facing competition from other investment avenues for deposits," said Sumit Phakka, deputy managing director, retail at IDBI Bank. "The limited transition in deposit rates means that bank margins which were on the mend will remain under pressure for some more time as banks adjust their lending rates to the new benchmarks."

Analysts say bank net interest margins (NIMs), which were on the mend, will also remain under pressure for longer.

"The latest cut means margin improvement has been delayed," said Ankit Jain, associate director, India Ratings & Research. "We now expect bank margins to stabilise only by the fourth quarter of the fiscal and improve only from the first quarter of the next fiscal onwards."

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

...moreless

(You can now subscribe to our ETMarkets WhatsApp channel)

(What's moving Sensex and Nifty Track latest market news, stock tips, Budget 2025, Share Market on Budget 2025 and expert advice, on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds .)

Subscribe to ET Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price

...moreless